The Problem and Motivation Behind

“In Mali, hunger is a serious challenge. Many families can’t afford or access staple foods like rice, millet, or corn throughout the year — especially during droughts or inflation.” – Fatogoma.

Fatogoma Yacouba Doumbia (21-year-old) and his team studies agriculture economy that made them aware of how food insecurity is a persistent challenge in Mali, particularly in rural areas where agriculture is the primary source of livelihood. Despite their hard work, local farmers often face financial instability, especially during droughts or economic downturns, prices rise, and many families struggle to meet their basic food needs. This problem motivated Fatogoma and his to think a solution to mitigate these risks of droughts and inflations that contribute to the food insecurity.

The Innovative Solution

“The idea is to set up an insurance so that when you save money with the insurance company, you can take the equivalent of the money you save in kind — like rice, corn, millet … We believe that our solution can transform how people think about food security. Instead of relying on emergency aid, communities will have a sustainable way to ensure they always have enough to eat.” – Fatogoma.

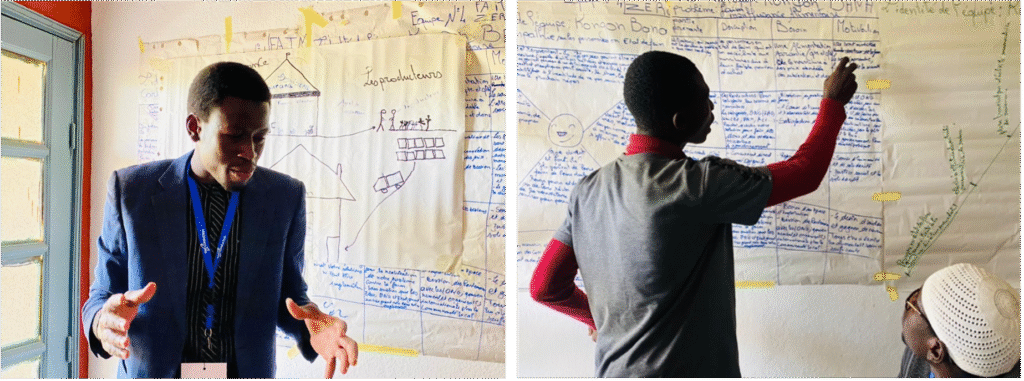

When Fatogoma and his team joined the Youth Innovation Lab, they chose to address the problem of food insecurity in their community. Fatogoma and his team applied a Design Thinking process. They began by empathising with local farmers to understand their financial struggles during and after the harvest season. Through discussions, they defined the core problem as many farmers find themselves in a cycle of debt, as they are forced to take high-interest loans from banks to finance agricultural activities. This financial burden leaves them with minimal profit after repaying debts, making it difficult to secure basic food supplies during times of crisis. Then, they brainstormed ways to combine financial savings with practical food security measures. They developed a prototype for a food security insurance scheme, KONGON BANA, which is simply a community safety net, where people stockpile large quantities of food when prices are low (post-harvest), then redistribute it at stable prices to members when prices spike. This not only prevents hunger but also empowers local farmers by buying directly from them and helping them prepare for the season.

They created four different subscription plans, designed to meet the needs of everyone:

- Nyesili Plan: Designed for people with regular jobs, allowing them to save a portion of their salary each month. In times of crisis, they can redeem their savings in the form of essential food items like rice, millet, and corn.

- Wasa Plan: Targeted at civil servants and stable income earners, where annual payments ensure access to food at a fixed average price, even during inflation.

- Eco Plan: Resembling local savings groups (VSLAs), this plan allows members to pool resources to support each other when needed.

- Daba Plan: Aimed at local agricultural producers, offering credit to finance farming activities. Producers can repay the credit after their harvest, with a minimal interest rate.

Their prototype received initial positive feedback from community members and agricultural economy specialists, as it not only stabilises food prices but also reduces dependence on high-interest loans. However, their solution remained a prototype without being tested due to the lack of funds required to purchase initial food stocks and set up the infrastructure for the insurance system.

Lessons Learned and Addressing Challenges

“The lab taught us how to work as a team and co-create new ideas. We learned that sometimes, the best solutions come from combining our thoughts rather than sticking to preconceived ideas.” – Fatogoma.

Fatogoma and his team received training from the Youth-led Innovation that helped them to apply Design Thinking to develop their solution. They have learned also importance of collaborative thinking and how to present their ideas confidently. Initially, the team faced challenges in convincing potential stakeholders of the project’s viability. Through mentorship from the lab, they developed stronger pitching skills and learned how to effectively communicate the solution’s benefits.

The main challenge remains securing financial support to operationalise their solution, as previously mentioned. However, Fatogoma and his team have continued refining their concept and engaging with stakeholders, hoping to secure the financial support needed to pilot the project and demonstrate its full potential within the community. To address that, they decided to start with their personal savings (about $500) as a starting capital for their solution. Additionally, they have identified potential areas of food supply and conducted surveys to assess demand. “We are going to start, but we will need the financial support of donors. We will also bring our contribution, that is the personal contribution. We are going to bring in 300,000 CFA [about $500] to support the project ourselves.” – Fatogoma explains.

Next Steps and Future Aspirations

“We are determined to make KONGON BANA a reality. Our goal is to ensure that no family goes without food during difficult times.” – Fatogoma.

Fatogoma and his team envision KONGON BANA as a long-term solution to food insecurity in Mali. They are committed to expanding the model to other regions once the pilot phase proves successful.

Their next steps involve

- securing initial funding to purchase food stocks and set up the insurance structure.

- collaborating with local agricultural cooperatives to source grains directly from farmers, ensuring fair pricing and sustainable practices.

- establishing partnerships with local government and NGOs to broaden the project’s reach and strengthen community involvement.